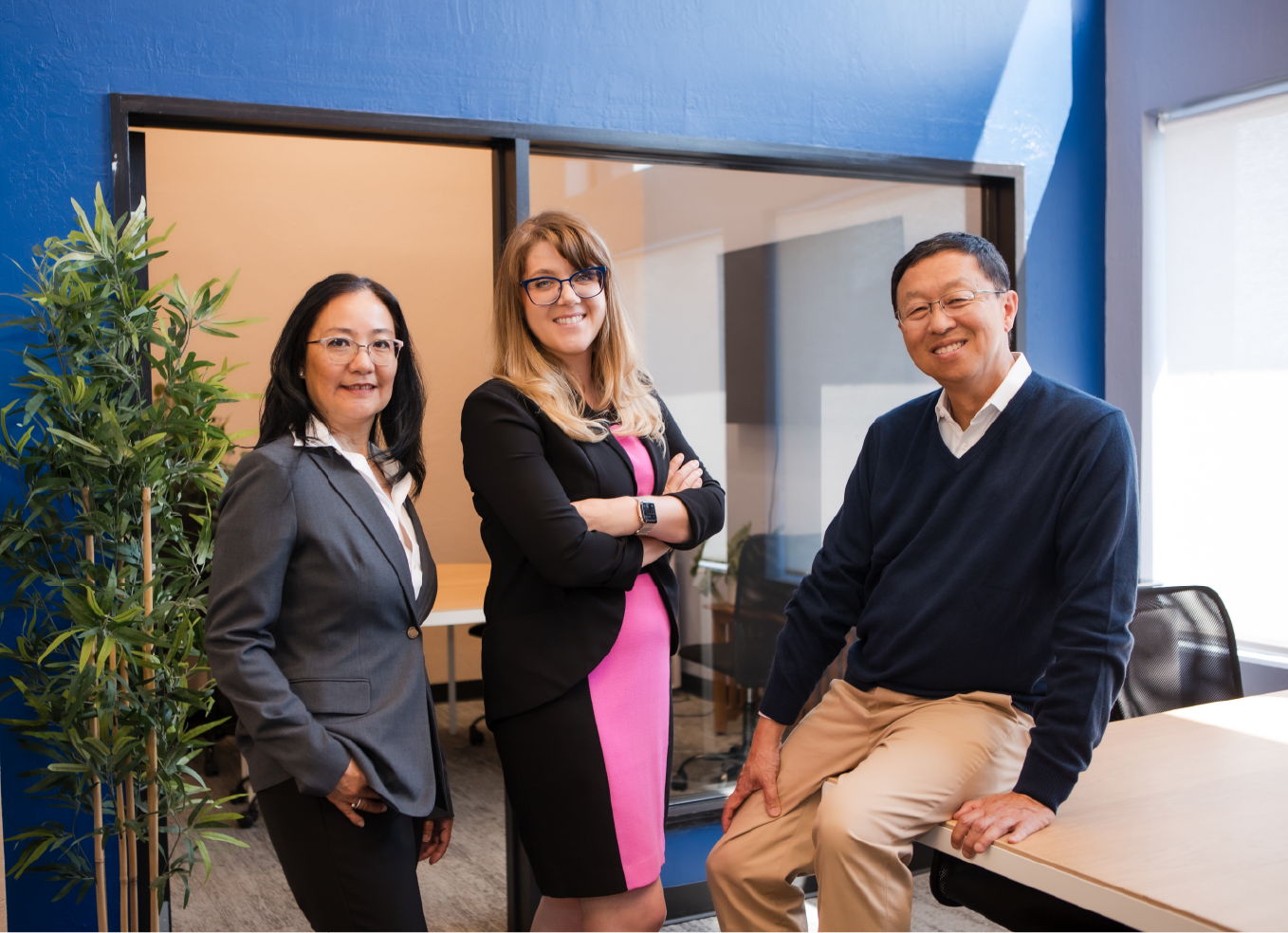

Who we are

TL Squared is a boutique accounting firm with offices in San Francisco Bay Area and New York City. Proudly women-owned, we are dedicated to delivering tailored accounting and financial solutions to empower small businesses and organizations.

What we do

We provide accounting and financial advisory services for small professional businesses and organizations. We specialize in audit-ready financial preparations for non-profit organizations and cash flow management for professional service providers.

CFO/Advisory services

• Financial forecasting and strategic planning

• Cash flow management

• Bank and investor relations

Controller functions

• Month-end closing

• Financial statement preparation

• Development of accounting procedures

Bookkeeping

• Accounts payable - expense processing

• Accounts receivable - customer invoice and payment processing

• Credit card and employee expense processing

HR & Payroll

• Payroll processing

• Employee onboarding and offboarding

• Human resources support

Audit management

• Preparation of audit-ready financials

• Audit process support

Good accounting practices

• Separation of duties

• GAAP compliance

• Secure information protocols